A senior gathering for invested real estate professionals to foster dealflow

With real estate investors refocusing and reallocating capital into their domestic markets, CEE countries like Poland and Czech Republic that rely heavily on foreign investments from Western Europe and Asia might need to rethink their regional transaction strategies. However, despite first signs of distress in the markets, the e-commerce boom might push CEE into the forefront of European investments in the long time favoured location for light industrial and logistics. Could this benefit the other sectors positively and how will recovery timelines behave?

Will pricing adapt to a new post-COVID reality and what would that mean for core, opportunistic and development pipelines? Will the CEE keep rising as a darling for Asian capital or will the money go elsewhere?

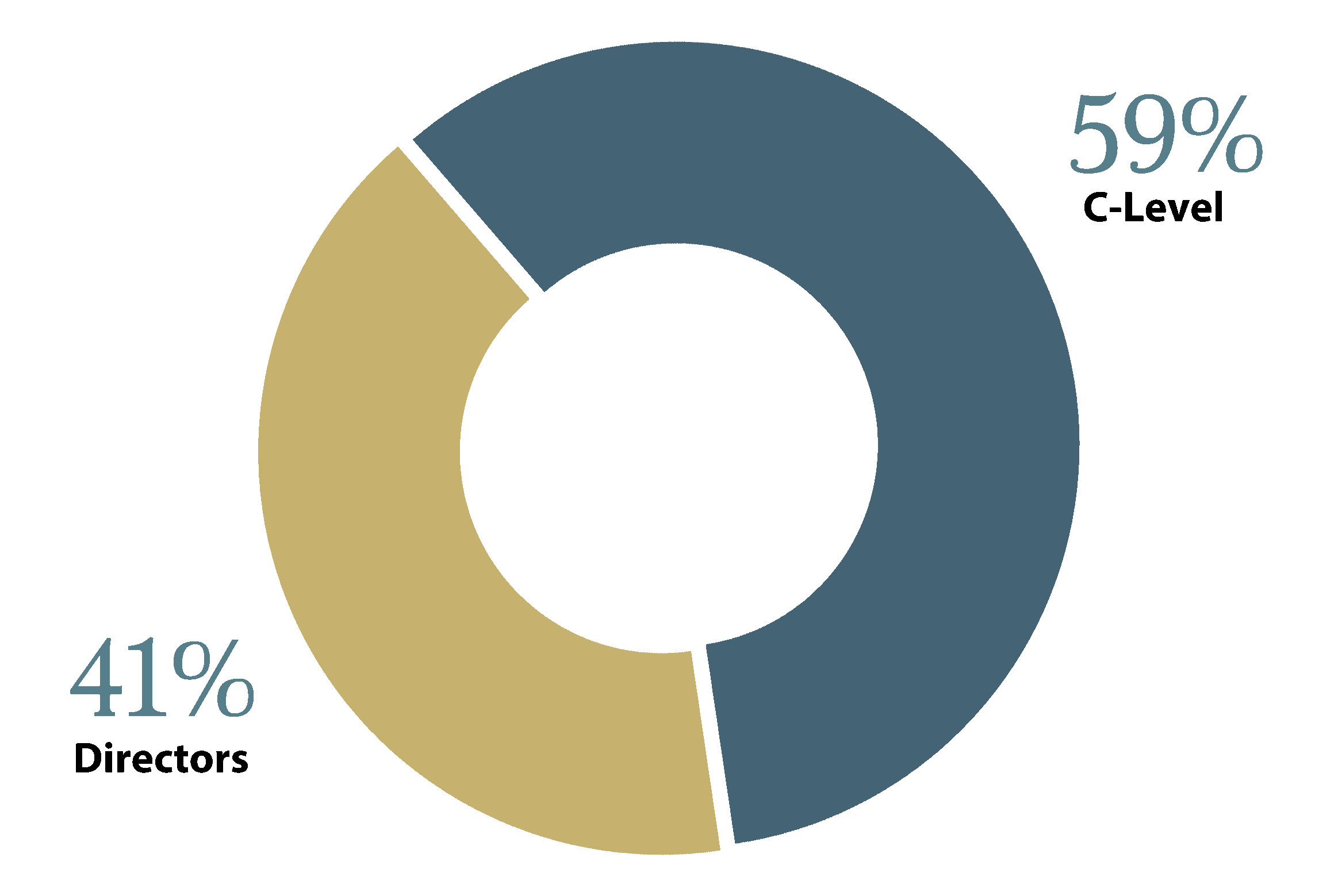

Now in its 16th year, participants find the discovery process for sourcing deal flow is most advantageous by welcoming the CEE’s most senior concentration of Private Equity Investors, Fund Managers, LP’s Developers, Asset Owners, Operators and Lenders invested across all CEE regions and asset classes. They will engage in a series of informal roundtables where everyone can participate, and navigate the current challenges presented by demand, purchasing and future trends.

Three elephants in the room: what is shaping the real estate market in CEE?

Three themes that will shape the future of real estate in Central Europe

1. Changes in consumer and business behavior following the Covid-19 crisis

2. Negative real interest rates to persist

3. New regulations and policies (to cope with environmental and social challenges)

Some of the confirmed participants

Asia out, Europe in?

Finding value across CEE

Post COVID financing gap or still liquid?

Distress wave or still no price clarity?

NPLs and distressed assets post-covid

Future proofing your investment strategy

The fight or the trigger against RE obsolescence?

Asia out, Europe in?

- Due Diligence - How to invest & transact with travel bans?

- Refocusing Asian Capital - Will traditional core markets be preferred investment destinations?

- European Money - Neighbouring countries still looking into CEE?

- Domestic Allocations - Will Poland and Czeck Republic learn best practices from the rest of CEE?

Finding value across CEE

- Poland & Czeck Republic - Still king of allocations, or not enough foreign capital to keep up?

- Investment Appetite - Which players are in, which are out?

- Valuations - Moving up the risk curve?

- Flight to Quality - Core to triumph?

Post COVID financing gap or still liquid?

- Debt & Financing - Liquidity available or run dry?

- Asset Classes - Which are the preferred ones?

- Source of Origin - Local or international?

- Debt Funds - “Mezz”ing up traditional lenders’ playing field?

Distress wave or still no price clarity?

- Repurposing Opportunities - Is now the time to buy obsolete assets?

- Pricing - Will renewed transactions give more transparency?

- Financing Options - Any (alternative) lenders active or all about refinancing?

- Raising Capital - Who’s in, who’s out?

NPLs and distressed assets post-covid

Future proofing your investment strategy

The fight or the trigger against RE obsolescence?

Transforming workspaces or distress wave imminent?

Obsolete Retail

Buying, selling or reinventing?

Logistics & Light Industrial

Nearshoring boom or oversupplied playing field?

Which regions at what prices?

Safe haven or still not mature enough?

Serviced residential in CEE

Blue ocean for investors?

Transforming workspaces or distress wave imminent?

- Risk Appetite - Core the only way to go?

- Capital Allocations - Is now the time to buy?

- Flex Offices - Future proof or too much volatility?

- Financing - Any availability or betting on refinancing?

Obsolete Retail

Buying, selling or reinventing?

- Consumer Demand - Strong appetite as positive retail outlook?

- E-commerce - Omnichannel solutions the only way to stay relevant?

- Distressed Assets - Repurposing opportunities for other asset classes?

- Retail Asset Types - Which have fared better, which worse & what lessons to learn

Logistics & Light Industrial

Nearshoring boom or oversupplied playing field?

- Incoming Supply - Oversupply concerns or still room to grow?

- Rental Growths - Where is the ceiling?

- Investment Appetite - Safe haven or too much competition?

- Big Boxes vs City Light Industrial - What asset types will be the way to go?

Which regions at what prices?

- Transactional & Investment Activity

- Yields - Still competitive or overpriced?

- Rental Growth - Underwriting investor confidence?

- Last Mile Equity, Core Yield & Capital - Limitless scale-up demand or cash on cash, tighter & tighter?

Safe haven or still not mature enough?

- Missing Supply - Repurposing other asset classes to counter lack of land?

- Stable Rental Returns - Dependent on location & rental fundamentals?

- Serviced Residential - Too much operational risk?

- Alternatives - Emerging assets to capture investment appetite?

- Capital Reallocations - Increased investment appetite maturing the asset class?

Serviced residential in CEE

Blue ocean for investors?

Agenda

Asia out, Europe in?

- Due Diligence - How to invest & transact with travel bans?

- Refocusing Asian Capital - Will traditional core markets be preferred investment destinations?

- European Money - Neighbouring countries still looking into CEE?

- Domestic Allocations - Will Poland and Czeck Republic learn best practices from the rest of CEE?

Post COVID financing gap or still liquid?

- Debt & Financing - Liquidity available or run dry?

- Asset Classes - Which are the preferred ones?

- Source of Origin - Local or international?

- Debt Funds - “Mezz”ing up traditional lenders’ playing field?

NPLs and distressed assets post-covid

Three elephants in the room: what is shaping the real estate market in CEE?

Three themes that will shape the future of real estate in Central Europe

1. Changes in consumer and business behavior following the Covid-19 crisis

2. Negative real interest rates to persist

3. New regulations and policies (to cope with environmental and social challenges)

Finding value across CEE

- Poland & Czeck Republic - Still king of allocations, or not enough foreign capital to keep up?

- Investment Appetite - Which players are in, which are out?

- Valuations - Moving up the risk curve?

- Flight to Quality - Core to triumph?

Distress wave or still no price clarity?

- Repurposing Opportunities - Is now the time to buy obsolete assets?

- Pricing - Will renewed transactions give more transparency?

- Financing Options - Any (alternative) lenders active or all about refinancing?

- Raising Capital - Who’s in, who’s out?

Which regions at what prices?

- Transactional & Investment Activity

- Yields - Still competitive or overpriced?

- Rental Growth - Underwriting investor confidence?

- Last Mile Equity, Core Yield & Capital - Limitless scale-up demand or cash on cash, tighter & tighter?

Serviced residential in CEE

Blue ocean for investors?

Obsolete Retail

Buying, selling or reinventing?

- Consumer Demand - Strong appetite as positive retail outlook?

- E-commerce - Omnichannel solutions the only way to stay relevant?

- Distressed Assets - Repurposing opportunities for other asset classes?

- Retail Asset Types - Which have fared better, which worse & what lessons to learn

Logistics & Light Industrial

Nearshoring boom or oversupplied playing field?

- Incoming Supply - Oversupply concerns or still room to grow?

- Rental Growths - Where is the ceiling?

- Investment Appetite - Safe haven or too much competition?

- Big Boxes vs City Light Industrial - What asset types will be the way to go?

Safe haven or still not mature enough?

- Missing Supply - Repurposing other asset classes to counter lack of land?

- Stable Rental Returns - Dependent on location & rental fundamentals?

- Serviced Residential - Too much operational risk?

- Alternatives - Emerging assets to capture investment appetite?

- Capital Reallocations - Increased investment appetite maturing the asset class?

Transforming workspaces or distress wave imminent?

- Risk Appetite - Core the only way to go?

- Capital Allocations - Is now the time to buy?

- Flex Offices - Future proof or too much volatility?

- Financing - Any availability or betting on refinancing?

Future proofing your investment strategy

The fight or the trigger against RE obsolescence?

Meet our exclusive format.

Much like a conversation in your own living room, the dynamic environment allows you to engage with your peers in an informal and collegial setting.

Image Gallery

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Sponsorship Opportunities

Our team will get back to you soon

Related events

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration

By continuing we'll assume you're on board with our privacy policy