A senior, closed-doors Real Estate meeting to help ignite deal flow in Spain

ABOUT ESPAÑA GRI

España GRI is an exclusive and senior Spanish & European Real Estate gathering that takes place in Madrid annually with the aim to help increase deal flow within the players in the industry.Industry leaders will engage in a series of informal roundtables where everyone can participate, and navigate the current challenges.

Private Equity Investors, Fund Managers, LP’s Developers, Asset Owners, Operators and Lenders invested in the Spanish market.

Agenda

Macroeconomic Volatility

Is the shadow of uncertainty still hunting us or are we on the verge of an inflection point?

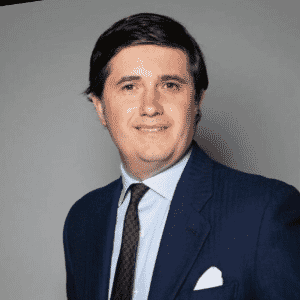

Carlos Montes-Galdón is a Lead Economist in the Directorate General of Economics at the European Central Bank. He holds a Ph.D. in Economics from Columbia University. His fields of interest include Macroeconomics and Monetary Economics, Mathematical and Quantitative methods, Macroeconometrics and Bayesian Statistics.

- ECB Forecast - European Economic Scenario Trends and Perspectives;

- Hefty Inflation - Interest Rates, GDP, and Monetary Policies;

- Lending Expectations for 2023-2024;

- Risks - Where are the current risks by the ECB in the economic outlook?

- Ukraine War - How has the war changed the Monetary Policies since its beginning?

Light Industrial & Logistics

Exhausted entry strategies, or rents still justifying money pour?

Value-add & Opportunistic

Growing investor risk appetite or ’Wait and See’ tension holding it back?

- Which real estate sector is starting to see more structure?

- Development Deals - Are the numbers working?

- Finding Value in New Locations - Where are the hotspots?

- Structural Shifts and Repricing in Traditional Assets - Where are the future yields to be hunted?

- NPL’s - Will distressed deals come onto the market?

Residential

Up goes demand, deals, and prices, where can we predict pushback?

- Residential Real Estate - How will existing properties have to change or will the focus be on new buildings?

- Chronic Undersupply - Residential real estate as the safe haven in Spain?

- Financing - When will the market warm up once again?

- Governmental Strategies - What is their role in pricing and affordability?

- ESG - How does ESG affect the Investment life cycle costs?

Light Industrial & Logistics

Exhausted entry strategies, or rents still justifying money pour?

- Lenders and Owners - What are the impacts on rents due to the e-commerce slowdown?

- Locations - Are the suburban areas the newest hotspots for Logistics hubs?

- Financing - Wait and See affecting logistics financing. Or still worth the risk?

- Tenant Requirements - Sustainability as the new tangible-price factor?

- Tech - Smart Decisions, Automation, and AI to drive performance?

Alternative Lending

Moving forward to special situations or risks to be avoided?

- Demand Changes – Reasons behind conservative bank behavior & where can alternative lenders fill gaps in the market?

- Short-Term Lending – Will alternative lenders occupy a larger market share with mezzanine loans?

- Competition – Will refinancing play a bigger role and how will senior loans behave in this?

- Sustainability – Are you compliant with the EU’s SFDR regulation?

Investment Data Provocateur

High volumes in Spain even with buyer caution in the European Scenario?

With an experience of over 14 years in the Real Estate industry, David is currently the Head of Research Spain for BNP Paribas Real Estate. Focusing on the analysis of the evolution of the different segments of the sector.

- Market Outlook - What is the current real estate picture in Spain?

- Forecast - What to expect in the upcoming months?

- How well is Spain positioned in the European Scenario?

Cross-border Capital

How to keep the shine during Europe's slowdown?

- The Cycle - Allocating capital in Spain on the current inflationary scenario?

- Institutional Appetite - How does Spain position itself as an investment destination in Europe?

- Deal Flow - Where is the capital coming from and to which products?

Shopping & Retail

Hybrid retail rallying investors or still a long road to find confidence?

Hospitality

Greater liquidity and buying pressure, focus on core assets or value-add strategy?

- Investment Appetite - Which assets & locations are attracting investors?

- Liquidity - Highest liquidity levels, can we forecast a pushback?

- Sustainable Strategies - What are the strategies for current assets, ongoing deals and pipeline opportunities?

- Hotel Transaction Strategies - Develop, rebrand, wait or buy?

- Repurposing Assets - How are hospitality assets approaching the residential segment?

Senior Living & Health Care

Strong demand fundamentals matching the weight of money entering?

- An Aging Population - Can the market keep up with new projects?

- Inflation & Rising Utility Costs - Will affordability become the most important factor for tenants?

- Missing Products - New developments and repurposing of urban assets as a solution?

- Senior Residences, Assisted Living & Co - Which products work in which regions?

Shopping & Retail

Hybrid retail rallying investors or still a long road to find confidence?

- Investors Sentiment - Proved sector’s recovers, why are investors still unconfident?

- Values and Pricing - Have we seen rock bottom yet?

- Buy, Sell, or Diversify? - How to gain value out of retail assets?

- ‘Unified Retail’ – Seamless on-off shopping experience?

- Innovating Retail - What are the new trends? Where to make a difference as Landlord?

- ESG - Social aspects are beyond the facility of online shopping and technology?

Last Mile Logistics

Supply shortage keeping up with the e-commerce rise or asset prices too high?

Student Housing & Co-living

Real money coming in or right products just out of reach?

- Leasing Models - Can greater flexibility innovate the product offering?

- Escalating Utility & Construction Costs - Finding yields despite exploding costs?

- Demand & Supply Imbalance - Is now the time to scale up?

- Urban Location Opportunities - Neighbourhood assisted living to diversify portfolios & bridge the supply gap?

- ESG - Which tendencies are growing up in the segments?

Offices Vs. Workspaces

Still investor’s bedrock or will the market shift confidence to new assets?

- Redefining Core - Which assets are truly sustainable?

- Are we seeing real growth or a recalibration of Grade A?

- Innovation - Services, flex, hybrid working, "hotelization", are landlords ready for a change in demand?

- Grade B and C Locations - What is to be done to hold on to value?

- ESG - Tangible factor to defining future prices?

Last Mile Logistics

Supply shortage keeping up with the e-commerce rise or asset prices too high?

- Urban Appetite - How are the cities shaping the locations for Last Mile?

- Expectation vs Reality - Real money being invested to keep up with current demand?

- Online Channel - Have we reached the peak?

Bank Financing

Conservative approaches with inflation or finding a new financial lifeline with current prices?

American Investors in Madrid

The new Miami?

BTR

Core vs Opportunistic profiles, where’s the sweet spot?

- How will BTR assets have to adapt to structural, cyclical & demand changes?

- Liquidity – What to expect in terms of asset liquidity and future buyers? Which products?

- Financing – Current obstacles for alternative and traditional lenders?

- Development Framework – Challenges for developments at the local and regional levels?

Bank Financing

Conservative approaches with inflation or finding a new financial lifeline with current prices?

- Demand Changes - What are the mid-term expectations for financing?

- Complementary Finance - Are alternative lenders walking aside bankers?

- New Development Financing - Which assets and products still getting banks' attention?

American Investors in Madrid

The new Miami?

- Spanish Attractiveness - How Spain is positioned ahead of other EU countries?

- Investment Flow - Where is the money coming from and to which assets?

- Secondary Cities - Barcelona and Valencia on the roadmap of American investors?

- Local Partnerships - Open and easy for new business opportunities?

- Legal framework and Taxes - How to mitigate challenges on investment deals?

Investment Strategies Winners

Skyhigh asset prices, compressed yields, where to dig for opportunities?

Investment Strategies Winners

Skyhigh asset prices, compressed yields, where to dig for opportunities?

- Overcoming Distressed Scenarios - What are the resilient investment strategies?

- How will real estate have to adapt to structural, cyclical & demand changes?

- Where local investors are finding opportunities?

- Asset Valuations - Will we see further inconsistencies between buyers & sellers on prices?

- Technology - How is it driving investment and development?

- ESG - Are we changing the mindset to create real win-win scenarios?

Timetable

Macroeconomic Volatility

Is the shadow of uncertainty still hunting us or are we on the verge of an inflection point?

Carlos Montes-Galdón is a Lead Economist in the Directorate General of Economics at the European Central Bank. He holds a Ph.D. in Economics from Columbia University. His fields of interest include Macroeconomics and Monetary Economics, Mathematical and Quantitative methods, Macroeconometrics and Bayesian Statistics.

- ECB Forecast - European Economic Scenario Trends and Perspectives;

- Hefty Inflation - Interest Rates, GDP, and Monetary Policies;

- Lending Expectations for 2023-2024;

- Risks - Where are the current risks by the ECB in the economic outlook?

- Ukraine War - How has the war changed the Monetary Policies since its beginning?

Residential

Up goes demand, deals, and prices, where can we predict pushback?

- Residential Real Estate - How will existing properties have to change or will the focus be on new buildings?

- Chronic Undersupply - Residential real estate as the safe haven in Spain?

- Financing - When will the market warm up once again?

- Governmental Strategies - What is their role in pricing and affordability?

- ESG - How does ESG affect the Investment life cycle costs?

Light Industrial & Logistics

Exhausted entry strategies, or rents still justifying money pour?

- Lenders and Owners - What are the impacts on rents due to the e-commerce slowdown?

- Locations - Are the suburban areas the newest hotspots for Logistics hubs?

- Financing - Wait and See affecting logistics financing. Or still worth the risk?

- Tenant Requirements - Sustainability as the new tangible-price factor?

- Tech - Smart Decisions, Automation, and AI to drive performance?

Value-add & Opportunistic

Growing investor risk appetite or ’Wait and See’ tension holding it back?

- Which real estate sector is starting to see more structure?

- Development Deals - Are the numbers working?

- Finding Value in New Locations - Where are the hotspots?

- Structural Shifts and Repricing in Traditional Assets - Where are the future yields to be hunted?

- NPL’s - Will distressed deals come onto the market?

Alternative Lending

Moving forward to special situations or risks to be avoided?

- Demand Changes – Reasons behind conservative bank behavior & where can alternative lenders fill gaps in the market?

- Short-Term Lending – Will alternative lenders occupy a larger market share with mezzanine loans?

- Competition – Will refinancing play a bigger role and how will senior loans behave in this?

- Sustainability – Are you compliant with the EU’s SFDR regulation?

Investment Data Provocateur

High volumes in Spain even with buyer caution in the European Scenario?

With an experience of over 14 years in the Real Estate industry, David is currently the Head of Research Spain for BNP Paribas Real Estate. Focusing on the analysis of the evolution of the different segments of the sector.

- Market Outlook - What is the current real estate picture in Spain?

- Forecast - What to expect in the upcoming months?

- How well is Spain positioned in the European Scenario?

Cross-border Capital

How to keep the shine during Europe's slowdown?

- The Cycle - Allocating capital in Spain on the current inflationary scenario?

- Institutional Appetite - How does Spain position itself as an investment destination in Europe?

- Deal Flow - Where is the capital coming from and to which products?

Senior Living & Health Care

Strong demand fundamentals matching the weight of money entering?

- An Aging Population - Can the market keep up with new projects?

- Inflation & Rising Utility Costs - Will affordability become the most important factor for tenants?

- Missing Products - New developments and repurposing of urban assets as a solution?

- Senior Residences, Assisted Living & Co - Which products work in which regions?

Shopping & Retail

Hybrid retail rallying investors or still a long road to find confidence?

- Investors Sentiment - Proved sector’s recovers, why are investors still unconfident?

- Values and Pricing - Have we seen rock bottom yet?

- Buy, Sell, or Diversify? - How to gain value out of retail assets?

- ‘Unified Retail’ – Seamless on-off shopping experience?

- Innovating Retail - What are the new trends? Where to make a difference as Landlord?

- ESG - Social aspects are beyond the facility of online shopping and technology?

Hospitality

Greater liquidity and buying pressure, focus on core assets or value-add strategy?

- Investment Appetite - Which assets & locations are attracting investors?

- Liquidity - Highest liquidity levels, can we forecast a pushback?

- Sustainable Strategies - What are the strategies for current assets, ongoing deals and pipeline opportunities?

- Hotel Transaction Strategies - Develop, rebrand, wait or buy?

- Repurposing Assets - How are hospitality assets approaching the residential segment?

Last Mile Logistics

Supply shortage keeping up with the e-commerce rise or asset prices too high?

- Urban Appetite - How are the cities shaping the locations for Last Mile?

- Expectation vs Reality - Real money being invested to keep up with current demand?

- Online Channel - Have we reached the peak?

Offices Vs. Workspaces

Still investor’s bedrock or will the market shift confidence to new assets?

- Redefining Core - Which assets are truly sustainable?

- Are we seeing real growth or a recalibration of Grade A?

- Innovation - Services, flex, hybrid working, "hotelization", are landlords ready for a change in demand?

- Grade B and C Locations - What is to be done to hold on to value?

- ESG - Tangible factor to defining future prices?

Student Housing & Co-living

Real money coming in or right products just out of reach?

- Leasing Models - Can greater flexibility innovate the product offering?

- Escalating Utility & Construction Costs - Finding yields despite exploding costs?

- Demand & Supply Imbalance - Is now the time to scale up?

- Urban Location Opportunities - Neighbourhood assisted living to diversify portfolios & bridge the supply gap?

- ESG - Which tendencies are growing up in the segments?

BTR

Core vs Opportunistic profiles, where’s the sweet spot?

- How will BTR assets have to adapt to structural, cyclical & demand changes?

- Liquidity – What to expect in terms of asset liquidity and future buyers? Which products?

- Financing – Current obstacles for alternative and traditional lenders?

- Development Framework – Challenges for developments at the local and regional levels?

American Investors in Madrid

The new Miami?

- Spanish Attractiveness - How Spain is positioned ahead of other EU countries?

- Investment Flow - Where is the money coming from and to which assets?

- Secondary Cities - Barcelona and Valencia on the roadmap of American investors?

- Local Partnerships - Open and easy for new business opportunities?

- Legal framework and Taxes - How to mitigate challenges on investment deals?

Bank Financing

Conservative approaches with inflation or finding a new financial lifeline with current prices?

- Demand Changes - What are the mid-term expectations for financing?

- Complementary Finance - Are alternative lenders walking aside bankers?

- New Development Financing - Which assets and products still getting banks' attention?

Investment Strategies Winners

Skyhigh asset prices, compressed yields, where to dig for opportunities?

- Overcoming Distressed Scenarios - What are the resilient investment strategies?

- How will real estate have to adapt to structural, cyclical & demand changes?

- Where local investors are finding opportunities?

- Asset Valuations - Will we see further inconsistencies between buyers & sellers on prices?

- Technology - How is it driving investment and development?

- ESG - Are we changing the mindset to create real win-win scenarios?

Image Gallery

Media partner

Special rates for España GRI 2023

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Sponsorship opportunities

Our team will get back to you soon

Related events

Attendees

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration

By continuing we'll assume you're on board with our privacy policy