A series of closed-door discussions for senior, international and local real estate players in India

In Mumbai, CEOs, Directors and senior executives will meet in an intimate and informal environment to strengthen their business relationships and establish the guidelines that will drive the Indian real estate sector in the coming years.

As GRI Club’s main goal is to develop meaningful relationships, the venue will feature spaces exclusively for private meetings, and the staff will support the matchmaking with potential business partners.

Be part of the most important Real Estate meeting in India and connect with leaders in a high-level networking environment.

Agenda

Master Session - Capital Deal Flows in India: Hot investment destination or capital deployment headache?

- Future Construction Finance - New future reality?

- Capital - Rising costs?

- Land Parcels - What are the main challenges on land acquisition?

- Future Landbank - New developments coming or a distant mirage?

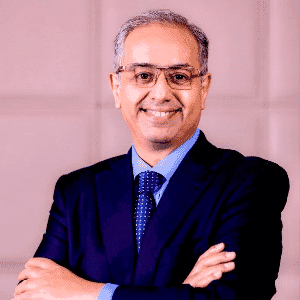

Lata Pillai

Ramesh Nair

Offices & The Great ‘De-Densification’

What makes sense for future pricing, location and demand?

- Investment Demand - More investments coming with demand comeback?

- Location - Asset diversification in other locations?

- Leasing - How to deal with negative pressure on rent and increase in vacancy and leverage?

- Asset Values - How might the acceleration to newer offices and space reductions hinder investment returns on older stock?

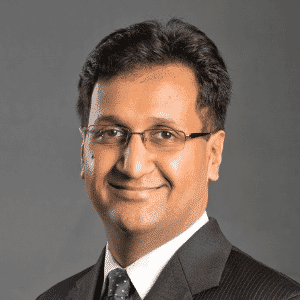

Adishesh Mitra

Amit Diwan

Light Industrial & Logistics

Continued upswing or about to hit glass ceiling?

- International Investment - Attracting more foreign capital?

- Land Acquisition - New land and construction costs affecting new investments?

- In-city Warehousing - A whole new market?

- More Deals & Projects - Will the market foresee a continuation of new developments?

Anshul Singhal

Construction Finance & Land Acquisition

New funding opportunities or hard to find land parcels?

- Future Construction Finance - New future reality?

- Capital - Rising costs?

- Land Parcels - What are the main challenges on land acquisition?

- Future Landbank - New developments coming or a distant mirage?

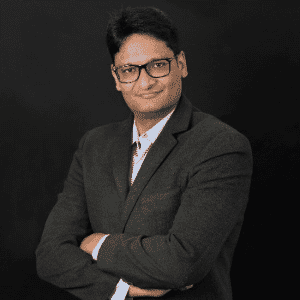

Gaurav Karnik

Sudhanshu Kejriwal

Shopping & Retail

Trust the resumption or time to change strategy for spaces?

- Buy & Sell Opportunities - What are the main deals?

- Physical Retail, Marketplace & E-commerce - Integrating physical-digital environments?

- Customer Experience - How to enhance it?

- Reposition of Assets & Mixed-Use - New strategies being taken?

- Trends to be Watched - Densification, mix-use, tier-2 cities expansion

Affordable & Mid-housing

Which opportunity pockets will the equity chase?

- Main Urban Areas - Main construction activities & development highlights

- Housing Prices & Sales - Will future demand continue its significant growth pace?

- Rents Increase - Secondary cities as alternative locations of new developments?

- Development Deals & Construction Costs - Riskier future highlights?

Bhairav Dalal

The impact of global economic headwinds on the Indian economy

- How is India ready for the new economic phase?

- Key Economic Indicators - What's calling attention?

- Real Estate Market View - Positioning India as an investment destination for international players?

- Future Highlights - What are the main challenges ahead & what can be expected in 2022?

Jitendra comes with two decades of rich investment research experience and has been with Credit Suisse for the last 12 years. He spearheads the India Investment Committee and he is the official spokesperson for Credit Suisse Wealth Management, India. As an expert on Indian macro, he has been researching several thematic investment ideas that can generate superior returns for investors.

Second Day Opening Session

The Future of Real Estate Development & Investments

- The Overall Economic Momentum - Hiccups remain, but is the real estate industry in India pegged for growth in the future?

- What does the future Mumbai residential market entail?

- Which pockets in Mumbai does one see more traction on sales and future development?

- Has the recent increase in interest rates by RBI had any impact on sales or strategy in acquiring land for development?

- How do the developers see the commercial market considering large deals and also the recent MMRDA disposal of land in BKC in favour of the Japanese company.

- Has the WFH / Covid impact been weaned in relation to occupancy in offices? How has rental flow been and escalations?

Distressed Funding

Mainstream liquidity or too few buyers?

- How many stressed assets are actually getting taken up?

- When mapping, what are the main strategies to asset classes, location, and risk levels?

- NPLs & Distressed - More acquisition appetite or conservative approaches?

- Market Opportunities - Will we see more and more JVs with domestic investors in the future?

Kunaal Shah

Piyush Gupta

Data Centres Growth

Structural, cyclical or digital paving the path?

- Core Markets - More supply to come?

- Demand and New Locations - Mumbai as main city or can we see growth and opportunities elsewhere?

- Highest Yields - Biggest ROI than any other asset class, yet why is supply still scarce?

- Competitive Barriers - New market opportunities with the supply and demand inbalance or regulatory limitations?

Deepak Jodhani

Srishti Ahuja

Matching Capital To Product

Primary assets in secondary cities better value than secondary assets in primary cities?

- Main Players - Going to new locations or still sticking into the main prime ones?

- New Opportunities - What are the emerging hotspots?

- Assets’ Deals - What are the strategies when looking at new core/core+, distressed, and value-add?

- Who’s in and who’s out in the quest for prime assets and locations?

- Scaling Business - Equity enough or debt finance to play an important role through a good range of lenders?

- Targets & Competitive Challenges - Are investors well positioned to capitalize on deals and locations or too much competition?

Shobhit Agarwal

ESG and Sustainable Financing

- India as a market for Green Financing – are we ready for it?

- Lenders’ positioning – do they have the supply of Green Capital for downstream lending?

- Investors’ outlook – increasing becoming a table stakes matter?

- Opportunity for Developers – for lowering the cost of capital and building a greener tomorrow?

Shashank Jain

Heading Nippon India Real Estate Investments since 2011 and a key personnel behind setting up RE investment business. Also instrumental in setting up and anchoring RE Private Equity business in his previous organisation (ICICI Prudential AMC).

Well diversified experience over entire life cycle of Funds from inception to exits and strong broad based relationship with developers and possesses rich experience in evaluating, investing and managing real estate projects on pan India basis.

Masters in Business Management and B.Tech. in Civil Engineering.

Heading Nippon India Real Estate Investments since 2011 and a key personnel behind setting up RE investment business. Also instrumental in setting up and anchoring RE Private Equity business in his previous organisation (ICICI Prudential AMC).

Well diversified experience over entire life cycle of Funds from inception to exits and strong broad based relationship with developers and possesses rich experience in evaluating, investing and managing real estate projects on pan India basis.

Masters in Business Management and B.Tech. in Civil Engineering.

Timetable

13:00 - 14:00 | Registration & Welcome Coffee

14:00 - 15:00 | Master Session

15:00 - 15:45 | Networking Coffee Break & GRI Matchmaking

15:45 - 16:45 | Breakout Discussions

16:45 - 17:15 | Networking Coffee Break & GRI Matchmaking

17:15 - 18:15 | Breakout Discussions

18:30 - 20:30 | Networking Cocktails & Dinner Reception

3rd November

09:30 - 10:30 | Registration & Welcome Coffee

10:30 - 10:50 | Plenary Opening Keynote Session

10:50 - 11:30 | Plenary Discussion Panel

11:30 - 12:00 | Networking Coffee Break. & GRI Matchmaking

12:00 - 13:00 | Breakout Discussions

13:00 - 14:30 | Lunch

14:30 - 15:30 | Discussion

15:30 - 16:00 | Networking Coffee Break. & GRI Matchmaking

16:00 - 17:00 | Closing Panel

17:00 - 18:00 | Closing Drinks

Confirmed Companies for 2022 edition

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Sponsorship Opportunities

Our team will get back to you soon

GRI in Action

Highlights of our previous editions

Meet our exclusive format

Listen from our Members

Related events

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration

By continuing we'll assume you're on board with our privacy policy