As the real estate market moves to adapt to a new normal, post COVID recovery; what opportunities for buying, repositioning and selling should we expect for Italian commercial and residential assets?

Will we see a gold rush of international equity and debt investors race for distress or will there be a lack of quality product outside of Milan? Does the risk/reward appetite make sense and what assets might prove resilient in the long term?

Now in its 8th year, participants find the discovery process for sourcing deal flow is most advantageous by welcoming domestic and international Private Equity Investors, Fund Managers, Debt Funds, NPL Buyers, LP’s Developers, Asset Owners, Operators and Lenders invested across all Italian regions and asset classes. They will engage in a series of informal roundtables where everyone can participate, and navigate the current challenges presented by demand, purchasing and future trends.

Discussions

Macroeconomic Outlook:

The post-COVID rebound, opportunities and risks

- The economic rebound after COVID-19: Strong demand, Supply woes, and Price pressures

- Inflation spike is largely temporary, central banks can afford to remain accommodative

- NGEU implications for Italy: Stronger growth, Higher likelihood of reforms and Tighter links to Europe

The Investment Cycle

Resilient investment strategies to overcome adversity

Development Deals & Urban Agenda:

Risky business?

The Investment Cycle

Resilient investment strategies to overcome adversity

- Growth opportunities: What are investors looking for?

- Capital flight: What countries are looking at Italy and which are walking away?

- Where can the best deals be found?

Development Deals & Urban Agenda:

Risky business?

- Reshaping & Rethinking The City of Milan

- Public & Private Sector Partnerships

- Milan 2026 (winter olympic games) - Building a legacy, placemaking, but what long term effects for the economy?

- Key Demand Drivers To Consider For The Long Term

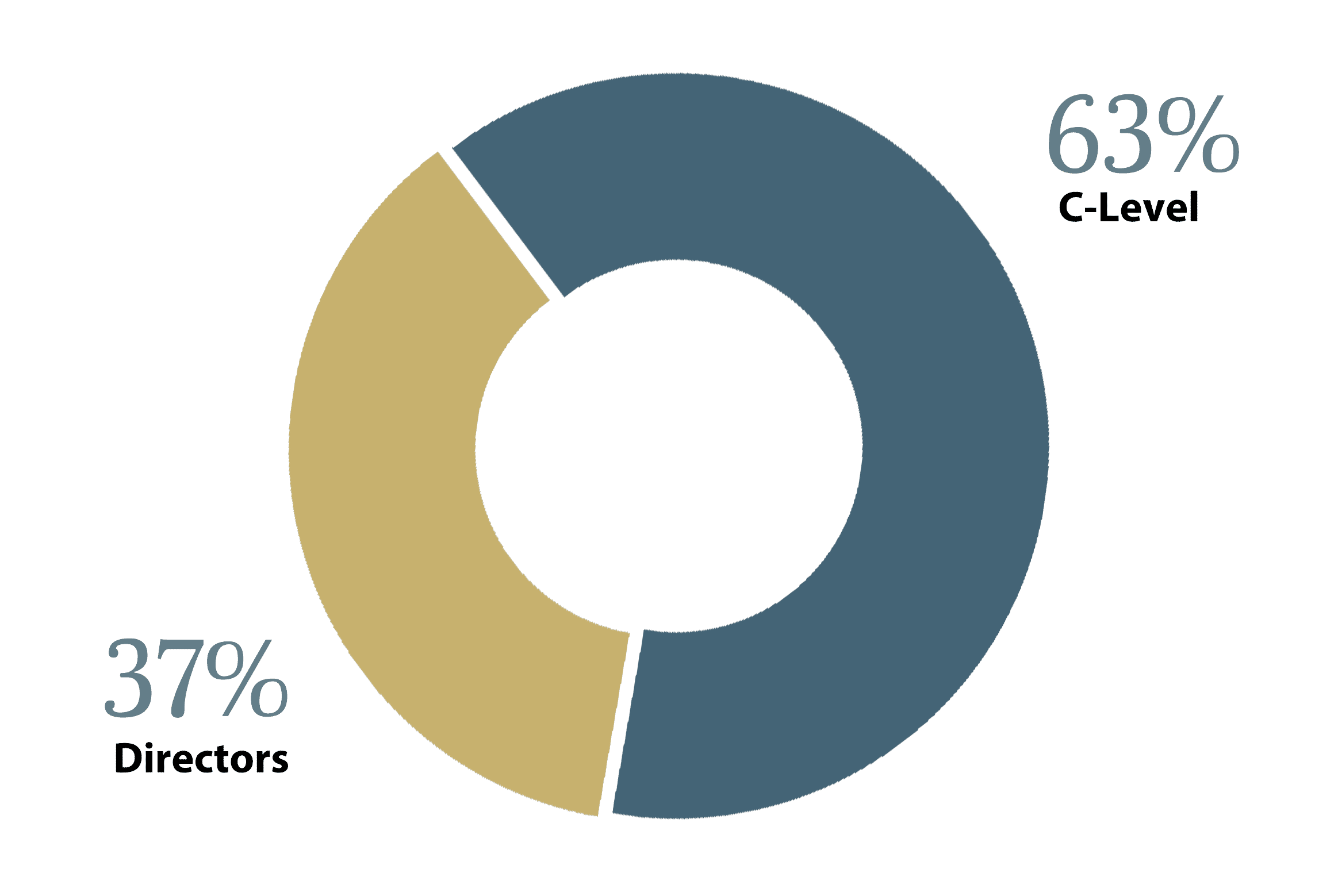

Some of the confirmed participants

The future of workspace

What’s the formula to attract and retain tenants?

Hospitality

Operators key to unlocking recovery or acquisitions only way back?

Resilient Retail:

Bright opportunities and eCommerce integration

Living Spaces:

How's the residential market shaping after covid?

Opportunistic and Value Add Strategies:

What’s new, what’s staying the same?

Warehouses and Last Mile Logistics:

The new trophy assets?

The future of workspace

What’s the formula to attract and retain tenants?

- Smart working and world after covid: how office and retail might be affected

- Flight to core, value add repositioning or flex are key

- New needs, less space, more product diversification?

- Tech in offices

- Biophilic offices: ESG approach with more attention to the planet

Hospitality

Operators key to unlocking recovery or acquisitions only way back?

- Governments moves?

- Local vs global coexistence?

Resilient Retail:

Bright opportunities and eCommerce integration

- Retail meets eCommerce - Bright future or conflict?

- Shopping Centres & Mixed Use for enhanced customer experience

- eCommerce click and collect: what does this mean for retail

Living Spaces:

How's the residential market shaping after covid?

- Valuations vs Value - How to get rational pricing back?

- Uses of ESG and tech to underwrite investor confidence and tenant retention

- Duff and Phelps to lead

- Role of the lender in recovery

Opportunistic and Value Add Strategies:

What’s new, what’s staying the same?

- Finding Value - Defense, resilience and risk curve strategies

- Race for Trophy Assets - True resilience or overpricing?

- Transactions & Dealflow Activity - Even spread or rush on Milan?

- Opportunistic Investments, Special Situations & Risk

Warehouses and Last Mile Logistics:

The new trophy assets?

- New process constitution?

- Specks of last mile assets

- Location: evaluation of land specification

- Yielding & returns of this asset class

- Stocking of goods - automated storages?

Agenda

Welcome Coffee

The Investment Cycle

Resilient investment strategies to overcome adversity

- Growth opportunities: What are investors looking for?

- Capital flight: What countries are looking at Italy and which are walking away?

- Where can the best deals be found?

04:00pm - 05:00pm

Coffee Break

The future of workspace

What’s the formula to attract and retain tenants?

- Smart working and world after covid: how office and retail might be affected

- Flight to core, value add repositioning or flex are key

- New needs, less space, more product diversification?

- Tech in offices

- Biophilic offices: ESG approach with more attention to the planet

Hospitality

Operators key to unlocking recovery or acquisitions only way back?

- Governments moves?

- Local vs global coexistence?

06:00pm - 07:00pm

Networking Drinks

Welcome Coffee

09:30am - 10:30am

Macroeconomic Outlook

The post-COVID rebound, opportunities and risks

- The economic rebound after COVID-19: Strong demand, Supply woes, and Price pressures

- Inflation spike is largely temporary, central banks can afford to remain accommodative

- NGEU implications for Italy: Stronger growth, Higher likelihood of reforms and Tighter links to Europe

10:30am - 11:30am

Coffee Break

Development Deals & Urban Agenda:

Risky business?

- Reshaping & Rethinking The City of Milan

- Public & Private Sector Partnerships

- Milan 2026 (winter olympic games) - Building a legacy, placemaking, but what long term effects for the economy?

- Key Demand Drivers To Consider For The Long Term

12:30pm - 02:00pm

Lunch Break

Living Spaces:

How's the residential market shaping after covid?

- Valuations vs Value - How to get rational pricing back?

- Uses of ESG and tech to underwrite investor confidence and tenant retention

- Duff and Phelps to lead

- Role of the lender in recovery

Resilient Retail:

Bright opportunities and eCommerce integration

- Retail meets eCommerce - Bright future or conflict?

- Shopping Centres & Mixed Use for enhanced customer experience

- eCommerce click and collect: what does this mean for retail

03:00pm - 03:30pm

Coffee Break

Warehouses and Last Mile Logistics:

The new trophy assets?

- New process constitution?

- Specks of last mile assets

- Location: evaluation of land specification

- Yielding & returns of this asset class

- Stocking of goods - automated storages?

Opportunistic and Value Add Strategies:

What’s new, what’s staying the same?

- Finding Value - Defense, resilience and risk curve strategies

- Race for Trophy Assets - True resilience or overpricing?

- Transactions & Dealflow Activity - Even spread or rush on Milan?

- Opportunistic Investments, Special Situations & Risk

04:30pm - 06:30pm

Farewell Drinks

Meet our exclusive format.

Much like a conversation in your own living room, the dynamic environment allows you to engage with your peers in an informal and collegial setting.

Images Gallery

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

NULL

Our team will get back to you soon

Related Events

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: info@griclub.org

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration